Global Programmatic Display Advertising Market Set to Reach USD 1,459.77 Billion by 2030

Surging Digitalization and Technological Innovations Propel Market Expansion

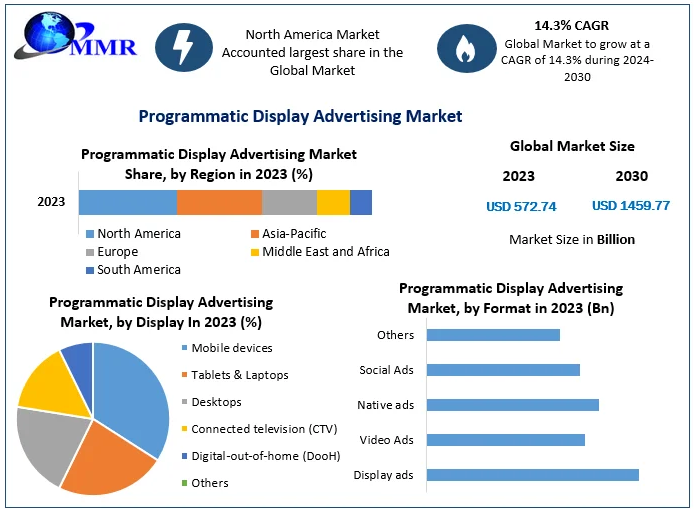

The Global Programmatic Display Advertising Market Size is on a trajectory of significant growth, projected to escalate from USD 572.74 billion in 2023 to an impressive USD 1,459.77 billion by 2030. This remarkable expansion reflects a robust compound annual growth rate (CAGR) of 14.3% over the forecast period.

Market Definition and Scope

Programmatic display advertising refers to the automated process of buying and selling digital ad space, utilizing algorithms and data insights to deliver targeted advertisements to specific audiences. This method enhances efficiency and effectiveness compared to traditional manual ad placements, encompassing various formats such as display ads, video ads, native ads, and social ads across multiple platforms.

Discover In-Depth Insights: Get Your Free Sample of Our Latest Report Today @https://www.maximizemarketresearch.com/request-sample/164771/

Market Growth Drivers and Opportunities

Several key factors are driving the expansion of the programmatic display advertising market:

-

Advancements in Artificial Intelligence (AI) and Machine Learning (ML): The integration of AI and ML technologies has revolutionized ad targeting and personalization, enabling advertisers to analyze vast datasets for precise audience segmentation and real-time bidding strategies.

-

Proliferation of Digital Devices: The widespread adoption of smartphones, tablets, and connected devices has increased digital media consumption, providing a fertile ground for programmatic advertising to reach consumers across various touchpoints.

-

Shift Towards Data-Driven Marketing: Organizations are increasingly leveraging data analytics to inform marketing decisions, with programmatic advertising offering the tools to harness consumer insights for optimized ad placements and improved return on investment (ROI).

-

Emergence of Retail Media Networks: Retailers are developing their own media networks, creating new avenues for programmatic advertising by offering advertisers access to first-party shopper data and the ability to reach consumers closer to the point of purchase.

Segmentation Analysis

The programmatic display advertising market can be segmented based on format, organization size, platform, and display type:

-

By Format:

-

Display Ads: Traditional banner advertisements displayed on websites and apps.

-

Video Ads: Engaging video content integrated within digital platforms.

-

Native Ads: Advertisements that match the form and function of the platform on which they appear, providing a seamless user experience.

-

Social Ads: Advertisements served on social media platforms, leveraging user data for targeted campaigns.

-

Others: Including rich media ads and interactive advertisements.

-

-

By Organization Size:

-

Small and Medium Enterprises (SMEs): Businesses with limited resources adopting programmatic advertising for cost-effective marketing solutions.

-

Large Enterprises: Organizations with substantial marketing budgets utilizing programmatic strategies for large-scale, data-driven campaigns.

-

-

By Platform:

-

Demand-Side Platforms (DSPs): Systems that allow advertisers to purchase digital ad inventory in real-time.

-

Supply-Side Platforms (SSPs): Platforms enabling publishers to manage and sell their ad inventory programmatically.

-

Data Management Platforms (DMPs): Tools that collect and analyze data to inform ad targeting and audience segmentation.

-

Ad Exchanges: Digital marketplaces facilitating the buying and selling of ad inventory between advertisers and publishers.

-

Ad Servers: Technology that stores and delivers advertisements to digital platforms.

-

Ad Networks: Companies that connect advertisers with websites that want to host advertisements.

-

-

By Display Type:

-

Mobile Devices: Smartphones and tablets, reflecting the growing trend of mobile-first advertising strategies.

-

Tablets & Laptops: Portable computing devices offering diverse advertising opportunities.

-

Desktops: Traditional computers, maintaining relevance in workplace and home settings.

-

Connected Television (CTV): Smart TVs and streaming devices, representing a burgeoning segment for programmatic ads.

-

Digital-Out-Of-Home (DOOH): Digital billboards and signage, expanding the reach of programmatic advertising into public spaces.

-

Others: Including emerging display technologies and platforms.

-

Country-Level Analysis

-

United States: As a pioneer in digital advertising, the U.S. continues to lead in programmatic adoption. In 2023, programmatic display advertising accounted for 35% of global ad spend, totaling approximately USD 45 billion. The integration of AI-driven tools and a mobile-first approach are key trends shaping the U.S. market.

-

Germany: Holding a significant share in the European market, Germany's programmatic ad spend contributed to Europe's 30% share of the global market in 2023, equating to around USD 37 billion. The implementation of stringent data privacy regulations, such as GDPR, has prompted German advertisers to focus on first-party data strategies and transparent programmatic platforms.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/market-report/programmatic-display-advertising-market/164771/

Competitive Analysis

The programmatic display advertising market is characterized by the presence of several key players striving to innovate and capture market share:

-

Google: A dominant force in the digital advertising landscape, Google offers a comprehensive suite of programmatic solutions, including its Demand-Side Platform (DSP) and Supply-Side Platform (SSP), facilitating seamless transactions between advertisers and publishers.

-

Facebook (Meta): Leveraging its vast user data, Facebook provides targeted programmatic advertising options across its social media platforms, enabling advertisers to reach specific demographics with precision.

-

Amazon Advertising: Capitalizing on its extensive e-commerce data, Amazon offers programmatic advertising services that allow brands to target consumers based on purchasing behavior and preferences.

-

Microsoft Advertising: Through strategic partnerships and technological advancements, Microsoft has expanded its programmatic advertising capabilities, offering solutions across its digital properties and networks.

-

Adobe Advertising Cloud: Providing an end-to-end platform for managing advertising campaigns, Adobe integrates data-driven insights with creative tools to enhance programmatic ad performance.

-

Taboola: Traditionally focused on native advertising, Taboola has expanded into programmatic display ads through its Realize platform, aiming to increase revenue for publishers and compete with established market leaders.

Future Outlook

The programmatic display advertising market is poised for continued growth, driven by technological innovations, the increasing importance of data-driven marketing strategies, and the expansion of digital media consumption. As advertisers seek more efficient and targeted methods to reach audiences, programmatic advertising is expected to remain at the forefront of digital marketing strategies.