Global Financial Crime and Fraud Management Solutions Market Size Expected to Reach USD 83.69 Billion by 2030 | Maximize Market Research

Market Estimation & Definition

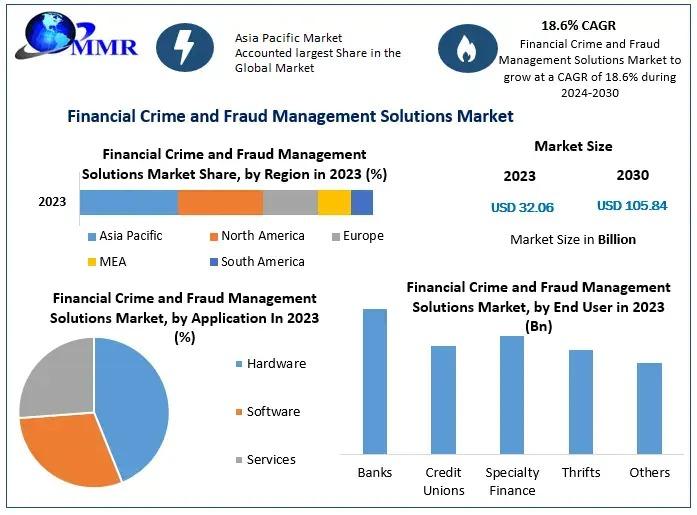

The Global Financial Crime and Fraud Management Solutions Market was valued at USD 33.47 billion in 2023 and is projected to reach USD 83.69 billion by 2030, growing at a CAGR of 14% during the forecast period. Financial crime and fraud management solutions refer to a suite of advanced tools and technologies designed to detect, prevent, and mitigate fraudulent activities within financial systems. These solutions encompass Anti-Money Laundering (AML), Know Your Customer (KYC), fraud detection, compliance management, transaction monitoring, and cybersecurity frameworks. Their adoption has become critical for banking, insurance, and fintech sectors, driven by rising financial crimes, regulatory mandates, and increasing digital transactions globally.

Get your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/33426/

Market Growth Drivers & Opportunity

Rising Incidences of Financial Crimes

The growing frequency and sophistication of financial crimes like identity theft, money laundering, cyber fraud, and insider trading are primary growth drivers. Global financial institutions are under immense pressure to safeguard assets and customer information amid rising digital payment adoption.

Regulatory Compliance Requirements

Stringent regulatory frameworks such as GDPR (General Data Protection Regulation), FATF (Financial Action Task Force) guidelines, and Anti-Money Laundering (AML) directives are compelling organizations to deploy robust fraud management solutions.

Digital Transformation in Banking & Financial Services

The rise in online banking, mobile wallets, and digital payment systems has increased vulnerability to fraud attacks. This transformation creates lucrative opportunities for fraud management solution providers.

Technological Advancements

The integration of Artificial Intelligence (AI), Machine Learning (ML), Big Data Analytics, and Blockchain technology enhances the capabilities of fraud management solutions, making them more predictive, adaptive, and scalable.

Increasing Demand for Real-Time Fraud Detection

Businesses require real-time monitoring systems to minimize financial losses and reputation risks, driving demand for intelligent and automated solutions across the BFSI (Banking, Financial Services, and Insurance) sector.

Download your sample copy of this report today: https://www.maximizemarketresearch.com/request-sample/33426/

Segmentation Analysis

By Component

- Solutions

- KYC Solutions

- AML Solutions

- Fraud Analytics

- Transaction Monitoring

- Services

- Professional Services

- Managed Services

The Solutions segment dominated the market in 2023 due to rising investments in fraud analytics and AML solutions.

By Deployment Mode

- On-Premise

- Cloud-Based

Cloud-Based solutions are projected to witness significant growth due to scalability, flexibility, and reduced infrastructure costs.

By Application

- Banks

- Insurance Companies

- E-commerce Merchants

- Payment Processors

- FinTech Companies

Banks accounted for the largest market share owing to the high vulnerability of banking operations to fraudulent activities.

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Large Enterprises continue to lead the market share; however, SMEs are increasingly adopting fraud management solutions due to rising cyber threats.

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

North America held the largest market share in 2023, followed by Europe and Asia Pacific

Country-Level Analysis (USA & Germany)

United States

The US is the largest market for financial crime and fraud management solutions globally. Factors driving growth include:

- High incidence of cyber fraud and identity theft

- Strict regulatory environment enforced by FINCEN and SEC

- Rapid adoption of AI-based fraud detection systems

- Presence of key market players like FICO, SAS Institute, and ACI Worldwide

The USA's advanced digital banking infrastructure and rising fintech investments further propel market growth.

Germany

Germany represents a key market in Europe for fraud management solutions due to:

- Implementation of stringent AML regulations

- Increasing cyber fraud incidents across banks and insurance sectors

- Growing adoption of RegTech (Regulatory Technology) solutions

- Expansion of digital banking and e-commerce platforms

Germany's proactive regulatory measures and technological adoption support robust market expansion.

Secure your sample copy of this report immediately: https://www.maximizemarketresearch.com/request-sample/33426/

Competitor Analysis

Key players operating in the Global Financial Crime and Fraud Management Solutions Market include:

| Company | Key Focus Area |

| FICO | Fraud Detection & Analytics |

| SAS Institute | Anti-Money Laundering & Risk Management |

| ACI Worldwide | Real-time Payments Fraud Protection |

| NICE Actimize | Financial Crime Prevention Platforms |

| Experian | Identity Verification & Fraud Detection |

| BAE Systems | Financial Crime & Cybersecurity Solutions |

| Fiserv | Integrated Fraud & Risk Management Solutions |

| IBM | AI-powered Fraud Detection Systems |

| Oracle | AML & KYC Solutions |

| ThreatMetrix | Digital Identity Intelligence |

These companies focus on strategic partnerships, technological innovations, and geographic expansion to strengthen their market position.

Want market insights? Read the summary of the research report for essential data:

|

|

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656