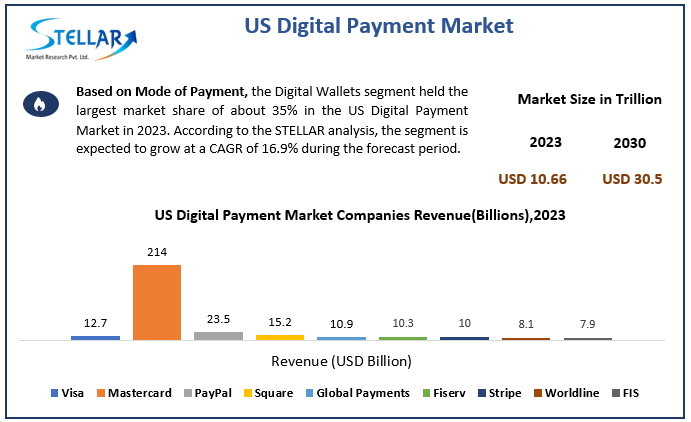

US Digital Payment Market Demand was valued at USD 10.66 trillion in 2023 and the total US Digital Payment revenue is expected to grow at a CAGR of 16.2% from 2024 to 2030, reaching nearly USD 30.5 trillion.

Market Estimation & Definition

Digital payments encompass electronic transactions made through various platforms, including mobile wallets, online banking, and contactless card payments. In the United States, the digital payment market has evolved to integrate innovative solutions that enhance transaction speed, security, and efficiency, redefining the financial ecosystem.

To delve deeper into this research, kindly explore the following link: https://www.stellarmr.com/report/US-Digital-Payment-Market/1575

Market Growth Drivers & Opportunities

Several key factors are propelling the growth of the digital payment market in the United States:

-

Surge in Mobile Payments: The convenience of swift, seamless transactions has led to widespread adoption of mobile payment platforms. In 2023, credit cards accounted for 70% of in-store transactions, while mobile wallets gained prominence in e-commerce, supported by the growing adoption of Buy Now, Pay Later (BNPL) and Peer-to-Peer (P2P) payment models.

-

Financial Inclusion: Digital payment platforms have extended financial services to previously unbanked populations, fostering economic inclusion and participation.

-

Enhanced Security Measures: Innovations such as biometric authentication and data tokenization have bolstered security, reducing fraud risks and increasing consumer trust in digital transactions.

-

Personalized Consumer Experiences: Businesses are leveraging data analytics to offer tailored solutions, enhancing customer engagement and driving e-commerce growth.

-

Technological Advancements: Collaborations among tech giants, banks, and fintech companies have resulted in innovative solutions that enhance transaction speed, security, and efficiency, redefining the financial ecosystem.

Segmentation Analysis

The US digital payment market is segmented based on service, solution, mode of payment, organization size, deployment mode, and industry:

-

By Service:

- Professional

- Managed

-

By Solution:

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

-

By Mode of Payment:

- Bank Cards

- Digital Wallets

- Point of Sales

- Net Banking

-

By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

-

By Deployment Mode:

- Cloud

- On-premises

-

By Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Transportation

Obtain your sample copy of this report now! https://www.stellarmr.com/report/req_sample/US-Digital-Payment-Market/1575

Country-Level Analysis: USA, Germany, and the Philippines

A comparative analysis of digital payment markets reveals distinct trends:

-

USA: The US leads the digital payment revolution, driven by technological advancements and consumer demand for efficient payment systems. Urban centers have emerged as hubs for innovation, while rural areas experience growth due to increasing internet penetration and smartphone adoption.

-

Germany: The German digital payment market is characterized by a strong preference for traditional banking methods, though there is a gradual shift towards digital solutions. The adoption of mobile payments and digital wallets is increasing, influenced by younger demographics and technological advancements.

-

Philippines: The Philippines has seen rapid growth in digital payments, driven by mobile wallet adoption and government initiatives promoting financial inclusion. The market is characterized by a young, tech-savvy population and increasing smartphone penetration.

Competitor Analysis

The US digital payment market features several key players:

-

PayPal Holdings, Inc.: A pioneer in online payments, offering a wide range of digital payment solutions.

-

Square, Inc.: Known for its innovative point-of-sale systems and mobile payment solutions.

-

Stripe, Inc.: Provides robust payment processing services for online businesses.

-

Visa Inc.: A global leader in digital payments, facilitating transactions worldwide.

-

Mastercard Incorporated: Offers a comprehensive range of payment solutions and services.

-

Apple Inc.: Developer of Apple Pay, integrating seamless payments into its ecosystem.

-

Google LLC: Offers Google Pay, providing a unified payment solution across platforms.

-

Amazon.com, Inc.: Provides Amazon Pay, streamlining payments for its vast customer base.

-

American Express Company: Known for premium payment solutions and services.

-

Wells Fargo & Co.: Offers a range of digital payment services through its banking platform.

-

Worldline: Provides payment and transactional services on a global scale.

-

Adyen: Offers a unified commerce platform for accepting payments globally.

These companies are at the forefront of innovation, continually enhancing their offerings to meet evolving consumer demands and technological advancements.

Check Out the Latest Trends :

Digital Newspapers and Magazines Market https://www.stellarmr.com/report/Digital-Newspapers-and-Magazines-Market/1558

Europe Big Data Market https://stellarmr.com/report/Europe-Big-Data-Market/1222

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656