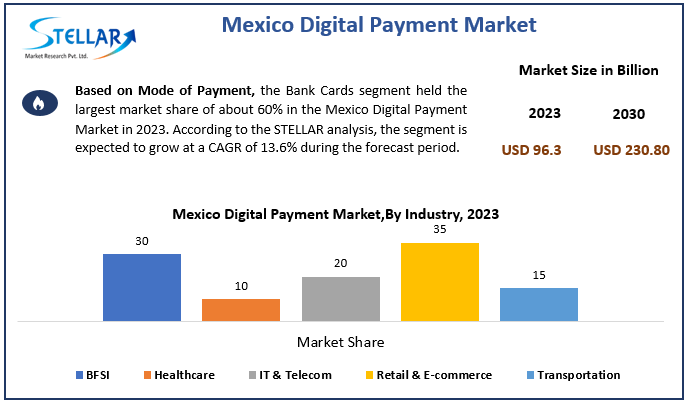

Mexico Digital Payment Market Demand was valued at USD 96.3 Bn. in 2023 and the total Mexico Digital Payment revenue is expected to grow at a CAGR of 13.3% from 2024 to 2030, reaching nearly USD 230.80 Bn.

Market Estimation & Definition

The Mexico digital payment market was valued at USD 94.6 billion in 2023 and is expected to expand at a CAGR of 16.8%, reaching approximately USD 289.3 billion by 2030.

Digital payments in Mexico include mobile wallets, online banking, contactless card transactions, and blockchain-based solutions. The country is experiencing a rapid shift toward a cashless economy, supported by government regulations, fintech growth, and increasing smartphone penetration.

Secure your sample copy of this report immediately! https://www.stellarmr.com/report/req_sample/Mexico-Digital-Payment-Market/1576

Market Growth Drivers & Opportunities

1. Surge in Mobile Wallet Usage

The adoption of mobile payment apps such as Mercado Pago, BBVA Wallet, and PayPal has skyrocketed due to increased smartphone penetration and consumer preference for fast, secure, and convenient transactions.

2. Government Initiatives Boosting Digital Payments

The Mexican government is actively promoting financial inclusion through initiatives like CoDi (Cobro Digital)—a platform developed by Banco de México to facilitate QR code-based digital transactions. This effort is accelerating the transition to a cashless economy.

3. Growth in E-Commerce Transactions

The expansion of e-commerce platforms such as Amazon, MercadoLibre, and Walmart Mexico is driving demand for secure online payment solutions, including credit/debit cards, BNPL (Buy Now, Pay Later), and digital wallets.

4. Rising Adoption of Contactless Payments

With the increasing use of NFC-enabled smartphones and POS terminals, contactless transactions are becoming more prevalent in retail, transportation, and hospitality industries.

5. Fintech Innovation & Open Banking

Mexico’s fintech ecosystem is thriving, with startups introducing AI-powered fraud detection, blockchain-based payments, and AI-driven credit scoring. The adoption of open banking regulations is further enhancing digital payment solutions.

Segmentation Analysis

The Mexico digital payment market is segmented based on payment type, deployment mode, industry vertical, and end-user:

By Payment Type:

- Mobile Wallets: Mercado Pago, BBVA Wallet, PayPal leading adoption.

- Credit & Debit Cards: Traditional banking still plays a major role.

- Buy Now, Pay Later (BNPL): Rapidly growing among online shoppers.

- Cryptocurrency Payments: Gaining traction in select industries.

By Deployment Mode:

- Cloud-Based: Increasing adoption among SMEs and startups.

- On-Premise: Preferred by major financial institutions.

By Industry Vertical:

- E-Commerce & Retail: The fastest-growing sector.

- Banking & Financial Services (BFSI): Driving secure transactions through AI and blockchain.

- Healthcare: Digital payment solutions improving medical billing processes.

- Transportation & Travel: Increasing adoption of contactless fare payments.

By End-User:

- Consumers: Increasing preference for digital wallets and BNPL solutions.

- Businesses: Growing adoption of B2B digital payments and automated invoicing.

To delve deeper into this research, please follow this link: https://www.stellarmr.com/report/Mexico-Digital-Payment-Market/1576

Competitive Analysis

The Mexico digital payment market is highly competitive, with banks, fintech startups, and global tech firms leading the space.

Key Market Players:

- Mercado Pago & PayPal: Dominating mobile wallet transactions.

- BBVA Wallet & Citibanamex: Leading in digital banking solutions.

- Visa & Mastercard: Expanding secure and contactless payment options.

- Klarna & Kueski Pay: Strengthening BNPL adoption.

- Oxxo Pay & CoDi: Boosting digital payment accessibility.

Conclusion

The Mexico digital payment market is on a high-growth trajectory, fueled by mobile wallet expansion, fintech advancements, and government-backed digitalization efforts.

With rising smartphone penetration and AI-driven payment security, Mexico is rapidly moving toward a cashless and digitally inclusive financial ecosystem.

Our Trending Related Report :

AI in Fintech Market https://www.stellarmr.com/report/AI-in-Fintech-Market/1564

Germany AI in FinTech Market https://www.stellarmr.com/report/Germany-AI-in-FinTech-Market/1567

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656