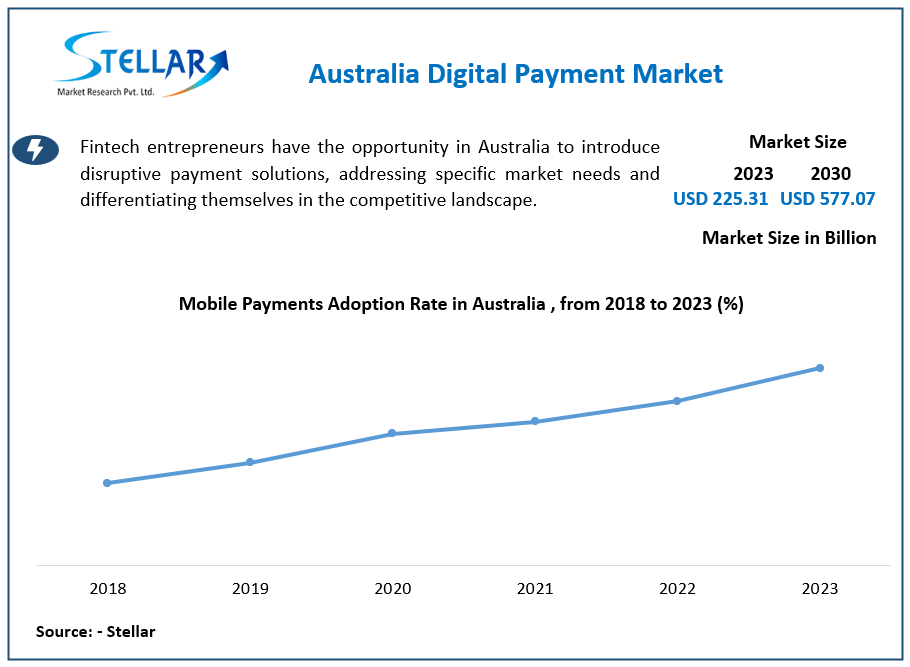

Australia Digital Payment Market Demand was valued at USD 225.31 Billion in 2023. The total Australia Digital Payment Market revenue is expected to grow at a CAGR of 14.38% from 2023 to 2030, reaching nearly USD 577.07 Billion in 2030.

Market Estimation & Definition

The Australia digital payment market was valued at USD 143.17 billion in 2023 and is expected to grow at a CAGR of 14.7% from 2024 to 2030, reaching approximately USD 372.65 billion by the end of the forecast period.

Digital payments refer to transactions made electronically through platforms such as mobile wallets, contactless cards, online banking, and cryptocurrency. The widespread adoption of cashless transactions in Australia is being driven by technological advancements, government initiatives, and changing consumer behavior.

Claim your sample copy of this report instantly! https://www.stellarmr.com/report/req_sample/Australia-Digital-Payment-Market/1577

Market Growth Drivers & Opportunities

1. Increasing Adoption of Contactless Payments

Australia is one of the leading countries in contactless payment adoption, with more than 90% of transactions now conducted using tap-and-go technology. The ease, speed, and security of these payments are fueling their growth across retail, hospitality, and e-commerce sectors.

2. Expansion of Fintech and Mobile Wallets

The rise of fintech startups and mobile payment solutions such as Apple Pay, Google Pay, and PayPal is accelerating digital payment penetration. These platforms offer seamless transaction experiences and are increasingly integrated into everyday financial activities.

3. Government Support for a Cashless Economy

The Australian government and the Reserve Bank of Australia (RBA) are actively promoting a cashless society by implementing policies that support digital financial transactions, fraud prevention, and open banking frameworks.

4. Growth in E-Commerce and BNPL Services

The boom in e-commerce and the popularity of Buy Now, Pay Later (BNPL) services such as Afterpay, Zip, and Klarna have significantly contributed to the adoption of digital payments. Consumers are opting for flexible, interest-free payment options, driving further market expansion.

5. Advancements in Blockchain and Cryptocurrency Payments

The increasing acceptance of cryptocurrencies for transactions and the implementation of blockchain-based payment solutions are reshaping Australia’s digital payment landscape. Businesses are exploring decentralized financial models, further diversifying payment options.

Segmentation Analysis

The Australia digital payment market is segmented based on payment type, deployment mode, industry vertical, and end-user:

By Payment Type:

- Bank Cards: Debit and credit cards remain dominant in cashless transactions.

- Mobile Wallets: Apple Pay, Google Pay, and Samsung Pay drive mobile payments.

- Buy Now, Pay Later (BNPL): Growing segment with increasing adoption by younger consumers.

- Cryptocurrency Payments: Emerging trend in blockchain-based financial transactions.

By Deployment Mode:

- Cloud-Based: Dominating due to flexibility and scalability in financial services.

- On-Premise: Preferred by large financial institutions for data security.

By Industry Vertical:

- Retail & E-Commerce: Leading sector with high digital payment penetration.

- BFSI (Banking, Financial Services & Insurance): Driving innovations in fintech and mobile banking.

- Healthcare: Increasing adoption of digital payments for telemedicine and hospital services.

- Hospitality & Travel: Contactless and mobile payments enhancing customer convenience.

By End-User:

- Individuals: Adoption of mobile wallets, BNPL, and contactless transactions.

- Businesses: Embracing digital invoicing and automated payment systems.

To delve deeper into this research, kindly explore the following link: https://www.stellarmr.com/report/Australia-Digital-Payment-Market/1577

Competitive Analysis

The Australia digital payment market is witnessing intense competition, with banks, fintech firms, and technology giants driving innovation and market expansion.

Key Market Players:

- Commonwealth Bank of Australia (CBA): Leading digital banking provider with mobile payment solutions.

- Afterpay: A pioneer in BNPL services, revolutionizing consumer financing.

- Zip Co Ltd.: Competing in the BNPL space with innovative payment models.

- PayPal Australia: A dominant force in online payments and digital transactions.

- Google Pay & Apple Pay: Expanding contactless payment adoption through smartphone integration.

Our Trending Related Report :

Mexico Social Commerce Market https://www.stellarmr.com/report/Mexico-Social-Commerce-Market/1600

Foldable Smartphone Market https://www.stellarmr.com/report/Foldable-Smartphone-Market/1632

Conclusion

The Australia digital payment market is on a strong growth trajectory, driven by contactless technology, fintech innovations, and government initiatives promoting a cashless economy.

With a tech-savvy consumer base, expanding e-commerce sector, and increasing adoption of mobile wallets and BNPL services, the market is set to redefine financial transactions in Australia. Businesses and consumers alike will benefit from faster, safer, and more efficient digital payment solutions in the years to come.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656