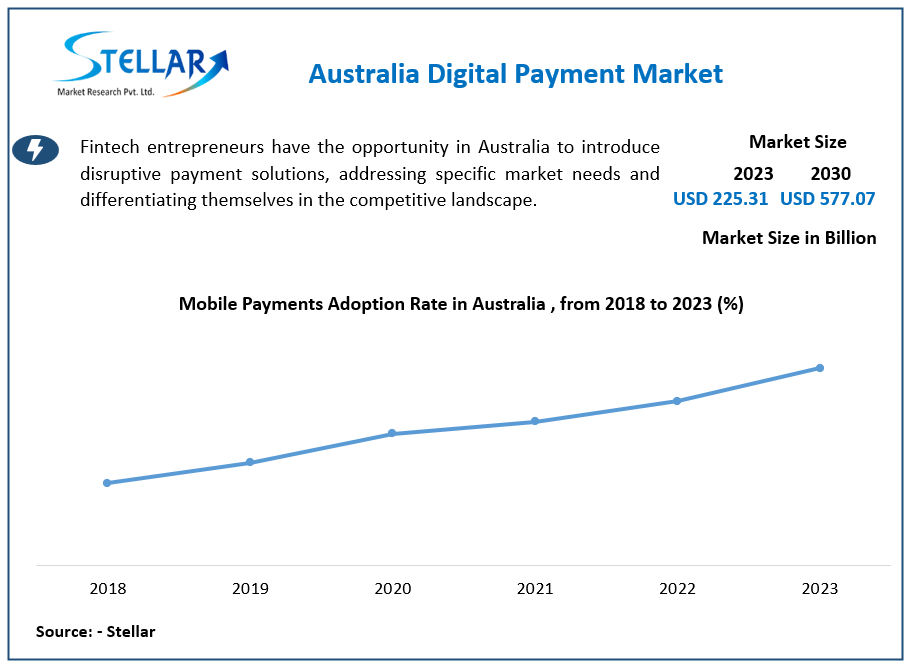

Australia Digital Payment Market Demand was valued at USD 225.31 Billion in 2023. The total Australia Digital Payment Market revenue is expected to grow at a CAGR of 14.38% from 2023 to 2030, reaching nearly USD 577.07 Billion in 2030.

Market Estimation & Definition

The Australian digital payment market was valued at USD 225.31 billion in 2023. It is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.38% from 2023 to 2030, reaching nearly USD 577.07 billion by 2030.

Digital payments encompass electronic transactions made through various platforms, including online banking, mobile wallets, and contactless payments. These methods offer consumers and businesses efficient, secure, and convenient alternatives to traditional cash transactions.

Download your sample copy of this report today! https://www.stellarmr.com/report/req_sample/Australia-Digital-Payment-Market/1577

Market Growth Drivers & Opportunities

Several factors are driving the expansion of the digital payment market in Australia:

-

Technological Advancements: Innovations such as numberless debit cards are enhancing security and user experience. For instance, AMP Bank, in partnership with Mastercard, has introduced numberless debit cards to combat fraud and scams. These cards display no numbers on the front, with the full 16-digit card number accessible only via the bank’s mobile app.

-

Decline in Cash Usage: There is a noticeable reduction in cash transactions, driven by the convenience and efficiency of digital payments. The number of bank branches and ATMs in Australia has halved over seven years, reflecting decreased demand for physical cash. Digital payments are on the rise, with mobile wallet usage surging and cash transactions declining sharply.

-

Regulatory Support: The Australian government is implementing policies to ensure inclusivity in payment methods. Starting January 1, 2026, businesses selling essential goods and services will be mandated to accept cash payments, ensuring that those who rely on cash are not excluded. This move balances the shift towards digital payments with the need for accessibility.

Segmentation Analysis

The digital payment market in Australia can be segmented based on various factors, including:

-

Payment Method:

- Mobile Wallets: The increasing adoption of smartphones has led to a surge in mobile wallet usage, offering consumers a convenient payment method.

- Contactless Cards: The introduction of innovative solutions like numberless debit cards enhances security and user trust in contactless payments.

-

End-User:

- Retail: Retailers are increasingly adopting digital payment solutions to meet consumer demand for quick and secure transactions.

- E-commerce: The growth of online shopping has necessitated the integration of various digital payment methods to facilitate seamless transactions.

To access more details regarding this research, visit the following webpage: https://www.stellarmr.com/report/Australia-Digital-Payment-Market/1577

Country-Level Analysis

While this analysis focuses on Australia, it's noteworthy that other countries are also experiencing significant shifts in their payment landscapes:

-

United States: Apple is expanding its tap-to-pay technology to competitors, allowing app developers to use the iPhone's NFC and security features for in-store payments. This move could enable consumers to use alternative digital wallets like PayPal on their iPhones at checkout.

-

Germany: Germany is witnessing increased investment in AI-driven financial services, focusing on enhancing operational efficiency and customer experience.

Competitive Analysis

The Australian digital payment market is characterized by significant developments:

-

Financial Institutions: Banks like AMP are innovating with products such as numberless debit cards to enhance security and user experience.

-

Technology Companies: Global tech giants are expanding their payment solutions into the Australian market, increasing competition and offering consumers more options.

-

Telecommunications Providers: Australian telcos are advocating for tech companies to contribute financially to essential services, highlighting the interconnectedness of digital infrastructure and payment systems.

Trending Related Report :

Germany Esports Market https://www.stellarmr.com/report/Germany-Esports-Market/1581

Mexico Esports Market https://www.stellarmr.com/report/Mexico-Esports-Market/1585

Conclusion

Australia's digital payment market is on a robust growth trajectory, driven by technological innovations, changing consumer preferences, and supportive regulatory frameworks. The projected growth underscores the increasing adoption of digital payment methods across various sectors. As the market evolves, stakeholders must navigate challenges such as ensuring inclusivity and maintaining security to capitalize on the burgeoning opportunities in the digital payment landscape.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656